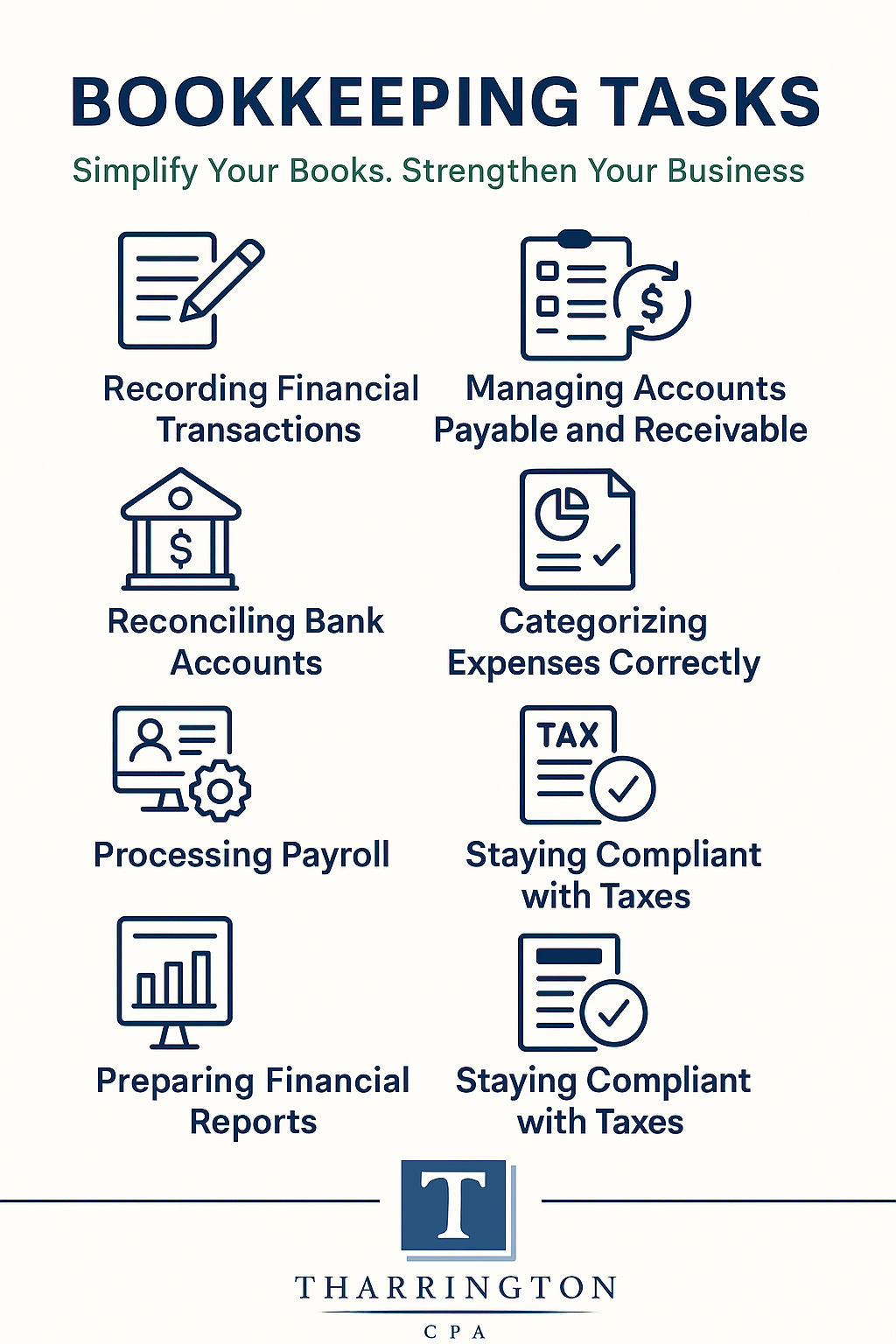

Essential Bookkeeping Tasks Every Small Business Should Prioritize

Keeping your business finances organized starts with effective bookkeeping. Bookkeeping tasks form the foundation of accurate financial management, helping business owners gain a clear understanding of their cash flow, make informed decisions, and stay compliant with tax laws. Whether you manage your own books or rely on a professional accountant, understanding the key bookkeeping tasks your business needs is essential for long-term success and maintaining overall financial health. Using centralized accounting software enables real-time access to financial data, improving decision-making and streamlining bookkeeping processes. Cloud-based accounting solutions further enhance collaboration and efficiency for bookkeeping tasks, allowing multiple users to access and update financial records seamlessly.

1. Recording Financial Transactions

At the core of bookkeeping lies the critical task of recording every financial transaction your business undertakes. This includes sales, purchases, receipts, and payments. Accurate recording of transactions ensures that your company’s financial records reflect the true state of your business’s finances. Many small businesses today utilize bookkeeping software such as QuickBooks Online or spreadsheet software to simplify this process. These tools help automate bank feeds, categorize transactions appropriately, and reduce the time-consuming nature of manual data entry. Bookkeeping software often includes features for managing client communications more effectively, enhancing client relationships. Systematically recording all daily sales, purchases, receipts, and payments into a journal or accounting software ensures consistency and accuracy. Properly recording transactions daily or weekly lays the groundwork for all subsequent financial reporting and analysis.

2. Managing Accounts Payable and Receivable

Maintaining a healthy cash flow requires diligent management of accounts payable and accounts receivable. Bookkeeping tasks in this area involve tracking invoices sent to customers, recording payments received, and monitoring outstanding balances to ensure timely collection. On the other side, managing accounts payable means entering bills promptly and paying them before their due date to avoid late fees and preserve strong vendor relationships. Automating accounts payable processes can reduce the time spent on manual invoice management, allowing businesses to focus on other critical tasks. Handling accounts receivable and payable effectively not only improves your business’s cash position but also supports accurate financial reporting and forecasting.

3. Reconciling Bank Accounts

Bank reconciliation is one of the most important monthly bookkeeping tasks. This process involves comparing your bank and credit card statements against the recorded transactions in your general ledger. Reconciling bank accounts helps identify discrepancies such as missing entries, duplicate charges, or bank errors. Regular reconciliation ensures that your company’s financial records are accurate and up to date, which is crucial for preparing reliable financial statements and maintaining trust with stakeholders. Reconcile accounts by comparing business bank and credit card statements to internal records to ensure accuracy. Professional bookkeepers often perform this task monthly as part of a comprehensive bookkeeping checklist.

4. Categorizing Expenses Correctly

Correctly categorizing your business expenses is vital for tax compliance and financial reporting. Every dollar spent should be assigned to the appropriate category, such as office supplies, travel, or utilities. Consistent categorization allows your tax accountant or CPA to identify deductible expenses and maximize tax savings during tax season. It also simplifies the preparation of income statements and balance sheets by providing clear financial data. Collecting and organizing all necessary receipts and invoices is important for tax returns, as it ensures that all expenses are properly documented and categorized. Photographing and digitally organizing all receipts for business expenses can further streamline this process, reducing the risk of lost documentation and improving efficiency.

5. Processing Payroll

For businesses with employees, payroll processing is an essential bookkeeping task that extends beyond simply issuing paychecks. It involves calculating wages, withholding payroll taxes, and remitting payments to tax agencies on time. Calculating salaries includes factoring in overtime, bonuses, and withholding taxes and benefit contributions to ensure accurate payroll management. Even if you outsource payroll processing to a specialized service, your bookkeeper should verify that payroll entries are accurately posted to the general ledger and reflected in your cash flow records. Proper payroll management ensures compliance with labor statistics regulations and timely payment of payroll taxes, helping avoid penalties and maintain employee satisfaction.

6. Tracking and Managing Assets

Bookkeeping encompasses more than just income and expenses; it also involves tracking your business’s assets such as equipment, vehicles, and property. Maintaining an accurate asset register, recording depreciation, and monitoring loan balances related to these assets provide a complete picture of your company’s value over time. Regularly tracking stock levels helps avoid overstocking or stock outages and guides future business decisions, ensuring that your business operates efficiently. This information is essential for preparing balance sheets and assessing your business’s overall financial health. Keeping detailed records of assets supports better decision-making regarding purchases, maintenance, and eventual asset disposal.

7. Preparing Financial Reports

Monthly bookkeeping tasks should culminate in the preparation of key financial reports that offer insights into your business’s financial performance and position. These reports typically include:

Income Statement (Profit and Loss Statement): Shows your business’s revenues and expenses over a specific period, highlighting profitability.

Balance Sheet: Provides a snapshot of your company’s assets, liabilities, and equity at a given point in time.

Cash Flow Statement: Tracks the inflow and outflow of cash, revealing your business’s cash position and liquidity. Accounting software can automatically generate financial statements, simplifying the reporting process and saving time for business owners. Use built-in reporting tools in accounting software to automate data extraction and report generation, further streamlining the preparation of these essential financial documents.

Accurate financial reports enable business owners to make informed decisions, plan for future growth, and prepare for tax filing. These financial reports offer valuable insights into performance and help meet regulatory requirements. They also serve as vital tools for communicating financial information to lenders, investors, and other stakeholders.

8. Staying Compliant with Taxes

Effective bookkeeping supports tax compliance by maintaining organized and accurate financial records throughout the year. This simplifies tasks such as income tax filing, sales tax remittance, and quarterly tax estimates. Keeping detailed records of business expenses, sales tax collected, and payroll taxes paid ensures that your tax accountant has the necessary data for timely and accurate tax returns. Developing a comprehensive compliance calendar outlines all key tax payment and filing deadlines relevant to clients, helping businesses stay on track. By adhering to a monthly bookkeeping checklist and staying current with tax deadlines, small businesses can minimize their tax liability and avoid costly penalties during tax season. Timely preparation and submission of required tax payments and forms are essential to avoid penalties and facilitate smooth audits, ensuring compliance with tax regulations.

Why Outsource Your Bookkeeping?

For many small businesses, outsourcing bookkeeping tasks to a certified public bookkeeper or an accounting firm offers significant advantages. Professional bookkeepers bring key skills and experience to handle the intricacies of bookkeeping work efficiently and accurately. They not only manage daily transactions and bank reconciliations but also provide valuable insights into managing cash flow, optimizing tax compliance, and improving financial reporting. Bookkeepers track expenses against a budget to identify areas for cost-cutting or investment, helping businesses allocate resources more effectively. Effective bookkeeping requires clear communication with clients about their financials and updates, ensuring transparency and trust. Reviewing financial performance regularly with the help of professional bookkeepers helps catch errors in records and align with the budget, ensuring that financial goals are met effectively. Outsourcing frees up business owners to focus on core business operations while ensuring that the company’s financial records are maintained to the highest standards.

At Tharrington CPA, PLLC, we specialize in full-service bookkeeping for small businesses across Charlotte, Monroe, and throughout North Carolina. Our bookkeeping services include monthly bookkeeping checklists, payroll processing, tax preparation support, and financial reporting tailored to your business needs. Partnering with us helps you maintain accurate financial records, meet compliance requirements, and make informed decisions that drive business growth.

Need Professional Bookkeeping Help?

Simplify your accounting process and safeguard your business’s financial health with expert bookkeeping assistance. Contact us today to learn how our professional bookkeepers can support your business.

📞 (704) 414-5488 | ✉️ will@tharringtoncpa.com

👉 Visit www.tharringtoncpa.com to schedule a consultation. For more information about our terms and limitations, please see our legal disclaimer.